February 20, 2026

Weekly Energy News

Market Commentary: NYMEX natural gas futures have recently drifted closer to $3.00/MMBtu, as short-term U.S. weather forecasts point to weaker demand and slower-than-expected storage withdrawals.

Over the past three trading sessions, the March contract has tested the low $2.90s, reflecting a more bearish outlook for the remainder of the winter. By late trading on February 19, the March contract was hovering near $2.98/MMBtu—down about three cents on the day as the market approached settlement, according to CME data.

MAR26’ NYMEX closed Thursday at $2.996

· High for the day $3.095

· Low for the day $2.976

Early trading for the prompt month is trading at $3.008

· https://www.cmegroup.com/markets/energy/natural-gas/natural-gas.html

· https://www.fxempire.com/commodities/natural-gas

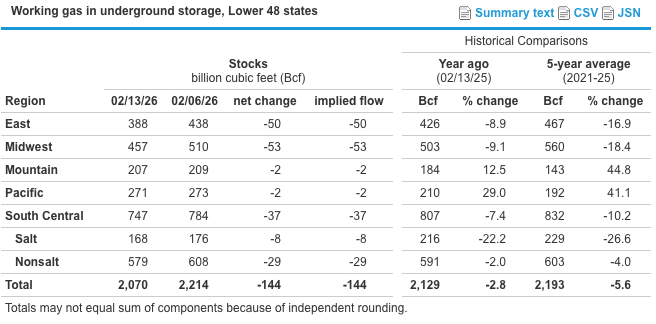

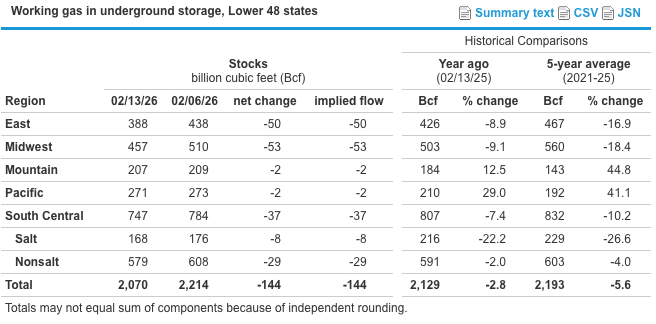

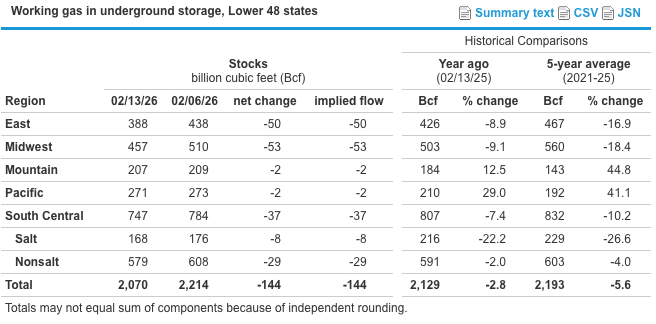

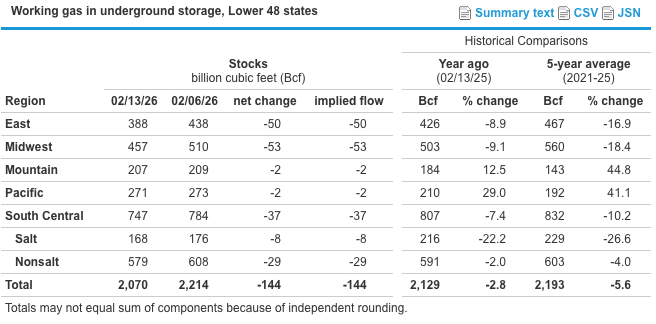

EIA Storage: U.S. natural gas storage withdrawals slowed in the week ending February 13, as milder temperatures across the Lower 48 reduced heating demand.

The U.S. Energy Information Administration reported a 144 Bcf withdrawal, bringing total working gas in storage down to 2.070 Tcf. The draw came in below market expectations. A Platts survey of analysts called for a 150 Bcf withdrawal.

Following the release of the report on February 19, the NYMEX March natural gas contract fell by roughly 7–8 cents, briefly trading just above $3.00 per MMBtu, according to CME data. In subsequent trading, the prompt-month contract rebounded and traded in a narrow range between $3.00 and $3.05 as the market digested the smaller-than-expected draw.

The latest report follows a string of unusually large withdrawals, including a 249 Bcf draw for the week ending February 6 and a record 360 Bcf withdrawal for the week ending January 30.

The slower draw for the week ending February 13 reflects a sharp decline in gas-fired heating demand, driven by warmer weather across the central and eastern United States.

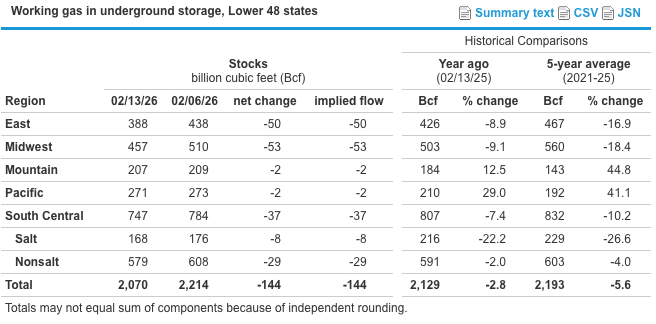

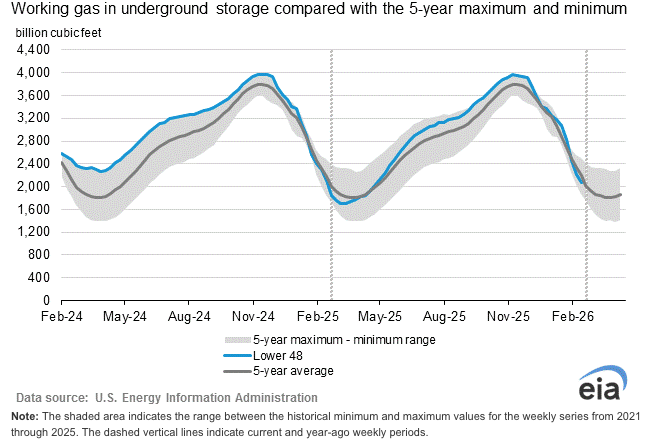

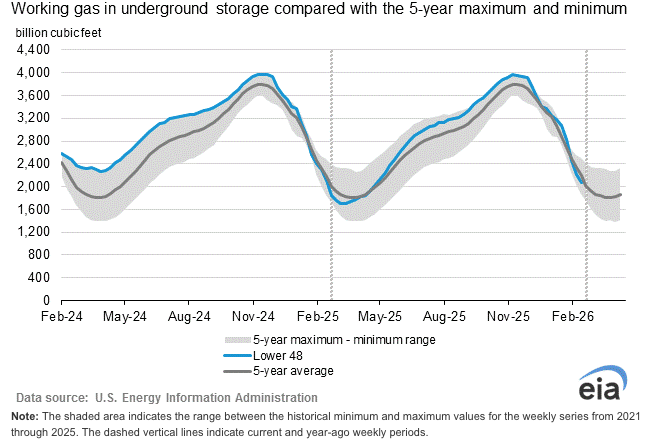

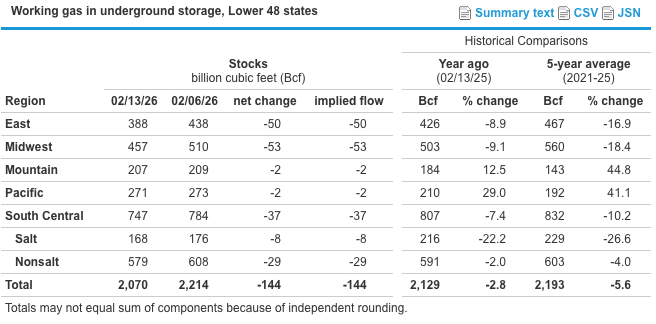

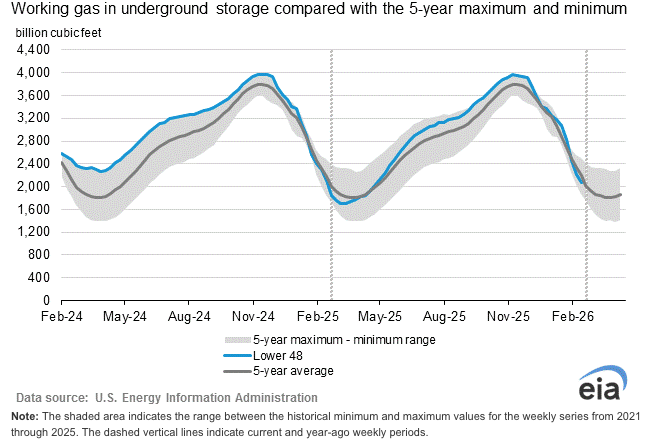

Summary: According to EIA estimates, working gas in storage totaled 2,070 Bcf as of Friday, February 13, 2026. This reflects a 144 Bcf withdrawal from the prior week.

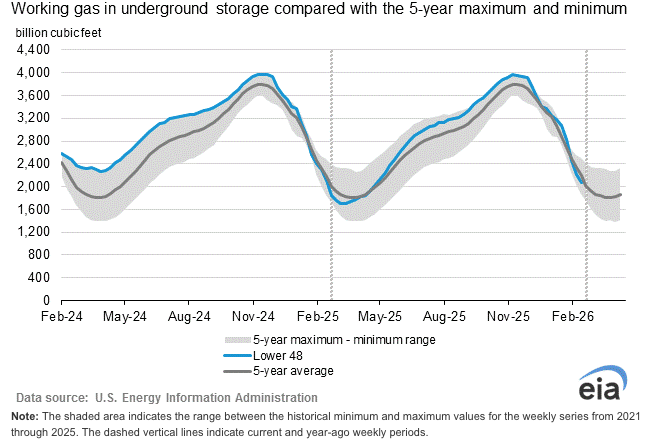

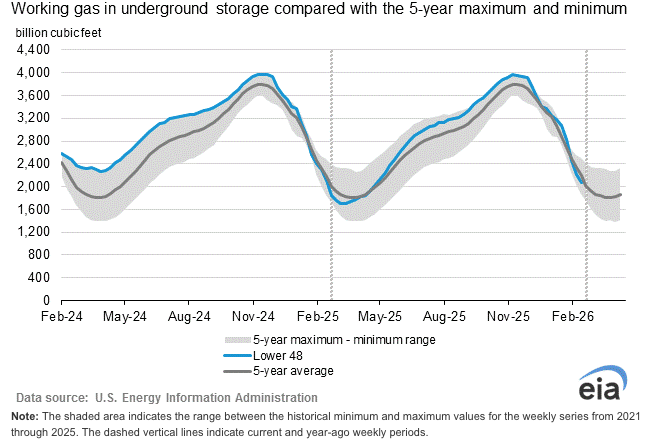

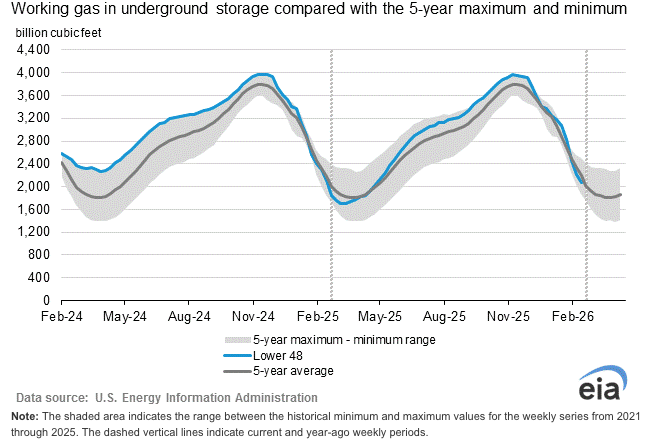

Storage levels are 59 Bcf lower than this time last year and 123 Bcf below the five-year average of 2,193 Bcf. At 2,070 Bcf, inventories remain within the five-year historical range.

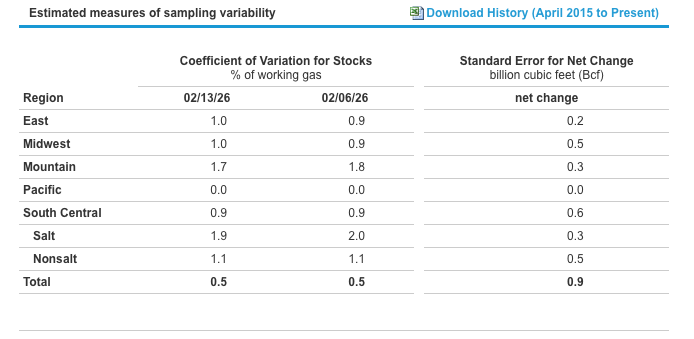

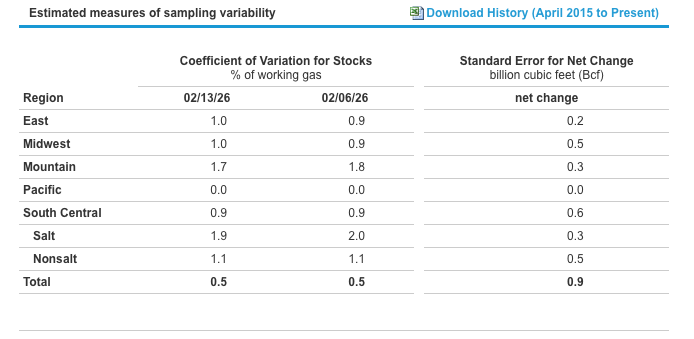

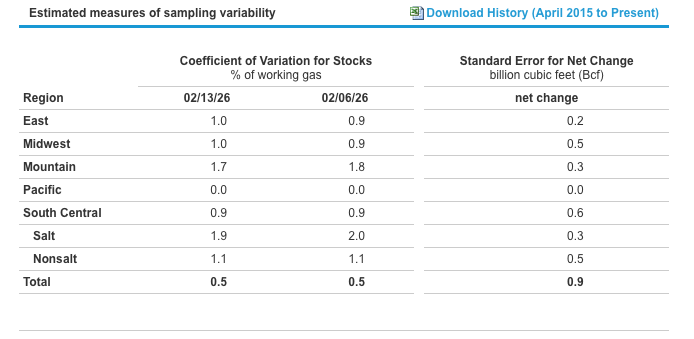

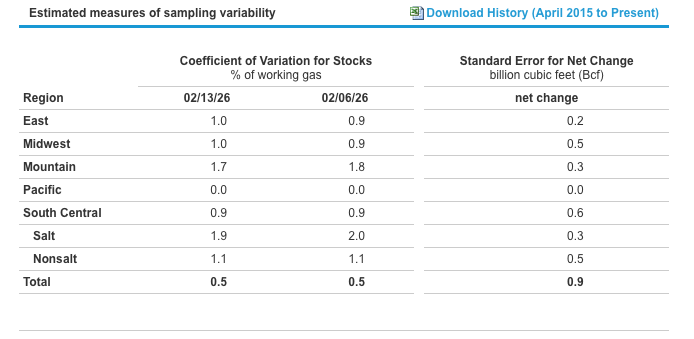

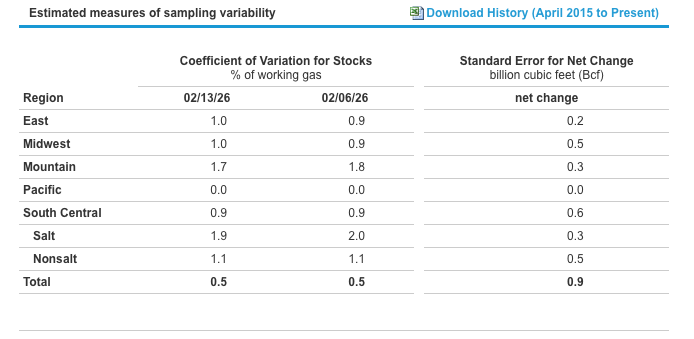

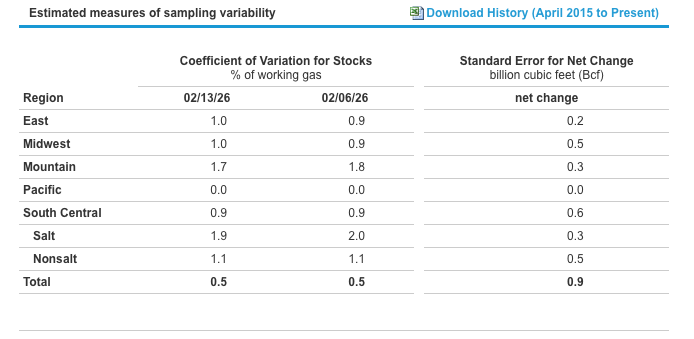

Additional details on sampling error are available in the Estimated Measures of Sampling Variability table below.

Note: The shaded area indicates the range between the historical minimum and maximum values for the weekly series from 2021 through 2025. The dashed vertical lines indicate current and year-ago weekly periods.

Weather: There is still some risk for colder weather in March, but the Euro weeklies’ signal for consistently below-average temperatures in the second half of the month to fade—similar to what has been seen repeatedly over the past six weeks.

While severe weather season typically ramps up in March, there is currently no clear signal for a sustained pattern that would support a prolonged period of severe weather. The overall pattern looks active through the month, but a more favorable setup would require stronger western U.S. troughing to eject systems into the Plains.

Ridging is expected to persist in the Gulf of Alaska into March, and its exact placement will be key in determining how far west any troughing can develop across the lower 48. One notable feature emerging in the upper-level pattern is ridging across the Southeast. This would tend to push the storm track farther north and introduce a stronger southwest flow. As a result, even without well-defined western troughing, Southeast ridging could still allow periodic systems to lift northward through the Plains and support broader warm sectors.

At this point, March is shaping up to feature above-average temperatures across the Midwest and likely much of the country. Precipitation also looks to run above normal, particularly across the Corn Belt and the Ohio Valley. Midwest Weather. “Early or Late Spring.” Midwest Weather (Substack), 2026. Subscriber-only newsletter.

February 20, 2026

Weekly Energy News

Market Commentary: NYMEX natural gas futures have recently drifted closer to $3.00/MMBtu, as short-term U.S. weather forecasts point to weaker demand and slower-than-expected storage withdrawals.

Over the past three trading sessions, the March contract has tested the low $2.90s, reflecting a more bearish outlook for the remainder of the winter. By late trading on February 19, the March contract was hovering near $2.98/MMBtu—down about three cents on the day as the market approached settlement, according to CME data.

MAR26’ NYMEX closed Thursday at $2.996

· High for the day $3.095

· Low for the day $2.976

Early trading for the prompt month is trading at $3.008

· https://www.cmegroup.com/markets/energy/natural-gas/natural-gas.html

· https://www.fxempire.com/commodities/natural-gas

EIA Storage: U.S. natural gas storage withdrawals slowed in the week ending February 13, as milder temperatures across the Lower 48 reduced heating demand.

The U.S. Energy Information Administration reported a 144 Bcf withdrawal, bringing total working gas in storage down to 2.070 Tcf. The draw came in below market expectations. A Platts survey of analysts called for a 150 Bcf withdrawal.

Following the release of the report on February 19, the NYMEX March natural gas contract fell by roughly 7–8 cents, briefly trading just above $3.00 per MMBtu, according to CME data. In subsequent trading, the prompt-month contract rebounded and traded in a narrow range between $3.00 and $3.05 as the market digested the smaller-than-expected draw.

The latest report follows a string of unusually large withdrawals, including a 249 Bcf draw for the week ending February 6 and a record 360 Bcf withdrawal for the week ending January 30.

The slower draw for the week ending February 13 reflects a sharp decline in gas-fired heating demand, driven by warmer weather across the central and eastern United States.

Summary: According to EIA estimates, working gas in storage totaled 2,070 Bcf as of Friday, February 13, 2026. This reflects a 144 Bcf withdrawal from the prior week.

Storage levels are 59 Bcf lower than this time last year and 123 Bcf below the five-year average of 2,193 Bcf. At 2,070 Bcf, inventories remain within the five-year historical range.

Additional details on sampling error are available in the Estimated Measures of Sampling Variability table below.

Note: The shaded area indicates the range between the historical minimum and maximum values for the weekly series from 2021 through 2025. The dashed vertical lines indicate current and year-ago weekly periods.

Weather: There is still some risk for colder weather in March, but the Euro weeklies’ signal for consistently below-average temperatures in the second half of the month to fade—similar to what has been seen repeatedly over the past six weeks.

While severe weather season typically ramps up in March, there is currently no clear signal for a sustained pattern that would support a prolonged period of severe weather. The overall pattern looks active through the month, but a more favorable setup would require stronger western U.S. troughing to eject systems into the Plains.

Ridging is expected to persist in the Gulf of Alaska into March, and its exact placement will be key in determining how far west any troughing can develop across the lower 48. One notable feature emerging in the upper-level pattern is ridging across the Southeast. This would tend to push the storm track farther north and introduce a stronger southwest flow. As a result, even without well-defined western troughing, Southeast ridging could still allow periodic systems to lift northward through the Plains and support broader warm sectors.

At this point, March is shaping up to feature above-average temperatures across the Midwest and likely much of the country. Precipitation also looks to run above normal, particularly across the Corn Belt and the Ohio Valley. Midwest Weather. “Early or Late Spring.” Midwest Weather (Substack), 2026. Subscriber-only newsletter.

February 20, 2026

Weekly Energy News

Market Commentary: NYMEX natural gas futures have recently drifted closer to $3.00/MMBtu, as short-term U.S. weather forecasts point to weaker demand and slower-than-expected storage withdrawals.

Over the past three trading sessions, the March contract has tested the low $2.90s, reflecting a more bearish outlook for the remainder of the winter. By late trading on February 19, the March contract was hovering near $2.98/MMBtu—down about three cents on the day as the market approached settlement, according to CME data.

MAR26’ NYMEX closed Thursday at $2.996

· High for the day $3.095

· Low for the day $2.976

Early trading for the prompt month is trading at $3.008

· https://www.cmegroup.com/markets/energy/natural-gas/natural-gas.html

· https://www.fxempire.com/commodities/natural-gas

EIA Storage: U.S. natural gas storage withdrawals slowed in the week ending February 13, as milder temperatures across the Lower 48 reduced heating demand.

The U.S. Energy Information Administration reported a 144 Bcf withdrawal, bringing total working gas in storage down to 2.070 Tcf. The draw came in below market expectations. A Platts survey of analysts called for a 150 Bcf withdrawal.

Following the release of the report on February 19, the NYMEX March natural gas contract fell by roughly 7–8 cents, briefly trading just above $3.00 per MMBtu, according to CME data. In subsequent trading, the prompt-month contract rebounded and traded in a narrow range between $3.00 and $3.05 as the market digested the smaller-than-expected draw.

The latest report follows a string of unusually large withdrawals, including a 249 Bcf draw for the week ending February 6 and a record 360 Bcf withdrawal for the week ending January 30.

The slower draw for the week ending February 13 reflects a sharp decline in gas-fired heating demand, driven by warmer weather across the central and eastern United States.

Summary: According to EIA estimates, working gas in storage totaled 2,070 Bcf as of Friday, February 13, 2026. This reflects a 144 Bcf withdrawal from the prior week.

Storage levels are 59 Bcf lower than this time last year and 123 Bcf below the five-year average of 2,193 Bcf. At 2,070 Bcf, inventories remain within the five-year historical range.

Additional details on sampling error are available in the Estimated Measures of Sampling Variability table below.

Note: The shaded area indicates the range between the historical minimum and maximum values for the weekly series from 2021 through 2025. The dashed vertical lines indicate current and year-ago weekly periods.

Weather: There is still some risk for colder weather in March, but the Euro weeklies’ signal for consistently below-average temperatures in the second half of the month to fade—similar to what has been seen repeatedly over the past six weeks.

While severe weather season typically ramps up in March, there is currently no clear signal for a sustained pattern that would support a prolonged period of severe weather. The overall pattern looks active through the month, but a more favorable setup would require stronger western U.S. troughing to eject systems into the Plains.

Ridging is expected to persist in the Gulf of Alaska into March, and its exact placement will be key in determining how far west any troughing can develop across the lower 48. One notable feature emerging in the upper-level pattern is ridging across the Southeast. This would tend to push the storm track farther north and introduce a stronger southwest flow. As a result, even without well-defined western troughing, Southeast ridging could still allow periodic systems to lift northward through the Plains and support broader warm sectors.

At this point, March is shaping up to feature above-average temperatures across the Midwest and likely much of the country. Precipitation also looks to run above normal, particularly across the Corn Belt and the Ohio Valley. Midwest Weather. “Early or Late Spring.” Midwest Weather (Substack), 2026. Subscriber-only newsletter.

February 20, 2026

Market Commentary: NYMEX natural gas futures have recently drifted closer to $3.00/MMBtu, as short-term U.S. weather forecasts point to weaker demand and slower-than-expected storage withdrawals.

Over the past three trading sessions, the March contract has tested the low $2.90s, reflecting a more bearish outlook for the remainder of the winter. By late trading on February 19, the March contract was hovering near $2.98/MMBtu—down about three cents on the day as the market approached settlement, according to CME data.

MAR26’ NYMEX closed Thursday at $2.996

· High for the day $3.095

· Low for the day $2.976

Early trading for the prompt month is trading at $3.008

· https://www.cmegroup.com/markets/energy/natural-gas/natural-gas.html

· https://www.fxempire.com/commodities/natural-gas

EIA Storage: U.S. natural gas storage withdrawals slowed in the week ending February 13, as milder temperatures across the Lower 48 reduced heating demand.

The U.S. Energy Information Administration reported a 144 Bcf withdrawal, bringing total working gas in storage down to 2.070 Tcf. The draw came in below market expectations. A Platts survey of analysts called for a 150 Bcf withdrawal.

Following the release of the report on February 19, the NYMEX March natural gas contract fell by roughly 7–8 cents, briefly trading just above $3.00 per MMBtu, according to CME data. In subsequent trading, the prompt-month contract rebounded and traded in a narrow range between $3.00 and $3.05 as the market digested the smaller-than-expected draw.

The latest report follows a string of unusually large withdrawals, including a 249 Bcf draw for the week ending February 6 and a record 360 Bcf withdrawal for the week ending January 30.

The slower draw for the week ending February 13 reflects a sharp decline in gas-fired heating demand, driven by warmer weather across the central and eastern United States.

Summary: According to EIA estimates, working gas in storage totaled 2,070 Bcf as of Friday, February 13, 2026. This reflects a 144 Bcf withdrawal from the prior week.

Storage levels are 59 Bcf lower than this time last year and 123 Bcf below the five-year average of 2,193 Bcf. At 2,070 Bcf, inventories remain within the five-year historical range.

Additional details on sampling error are available in the Estimated Measures of Sampling Variability table below.

Note: The shaded area indicates the range between the historical minimum and maximum values for the weekly series from 2021 through 2025. The dashed vertical lines indicate current and year-ago weekly periods.

Weather: There is still some risk for colder weather in March, but the Euro weeklies’ signal for consistently below-average temperatures in the second half of the month to fade—similar to what has been seen repeatedly over the past six weeks.

While severe weather season typically ramps up in March, there is currently no clear signal for a sustained pattern that would support a prolonged period of severe weather. The overall pattern looks active through the month, but a more favorable setup would require stronger western U.S. troughing to eject systems into the Plains.

Ridging is expected to persist in the Gulf of Alaska into March, and its exact placement will be key in determining how far west any troughing can develop across the lower 48. One notable feature emerging in the upper-level pattern is ridging across the Southeast. This would tend to push the storm track farther north and introduce a stronger southwest flow. As a result, even without well-defined western troughing, Southeast ridging could still allow periodic systems to lift northward through the Plains and support broader warm sectors.

At this point, March is shaping up to feature above-average temperatures across the Midwest and likely much of the country. Precipitation also looks to run above normal, particularly across the Corn Belt and the Ohio Valley. Midwest Weather. “Early or Late Spring.” Midwest Weather (Substack), 2026. Subscriber-only newsletter.

February 20, 2026

Weekly Energy News

Market Commentary: NYMEX natural gas futures have recently drifted closer to $3.00/MMBtu, as short-term U.S. weather forecasts point to weaker demand and slower-than-expected storage withdrawals.

Over the past three trading sessions, the March contract has tested the low $2.90s, reflecting a more bearish outlook for the remainder of the winter. By late trading on February 19, the March contract was hovering near $2.98/MMBtu—down about three cents on the day as the market approached settlement, according to CME data.

MAR26’ NYMEX closed Thursday at $2.996

· High for the day $3.095

· Low for the day $2.976

Early trading for the prompt month is trading at $3.008

· https://www.cmegroup.com/markets/energy/natural-gas/natural-gas.html

· https://www.fxempire.com/commodities/natural-gas

EIA Storage: U.S. natural gas storage withdrawals slowed in the week ending February 13, as milder temperatures across the Lower 48 reduced heating demand.

The U.S. Energy Information Administration reported a 144 Bcf withdrawal, bringing total working gas in storage down to 2.070 Tcf. The draw came in below market expectations. A Platts survey of analysts called for a 150 Bcf withdrawal.

Following the release of the report on February 19, the NYMEX March natural gas contract fell by roughly 7–8 cents, briefly trading just above $3.00 per MMBtu, according to CME data. In subsequent trading, the prompt-month contract rebounded and traded in a narrow range between $3.00 and $3.05 as the market digested the smaller-than-expected draw.

The latest report follows a string of unusually large withdrawals, including a 249 Bcf draw for the week ending February 6 and a record 360 Bcf withdrawal for the week ending January 30.

The slower draw for the week ending February 13 reflects a sharp decline in gas-fired heating demand, driven by warmer weather across the central and eastern United States.

Summary: According to EIA estimates, working gas in storage totaled 2,070 Bcf as of Friday, February 13, 2026. This reflects a 144 Bcf withdrawal from the prior week.

Storage levels are 59 Bcf lower than this time last year and 123 Bcf below the five-year average of 2,193 Bcf. At 2,070 Bcf, inventories remain within the five-year historical range.

Additional details on sampling error are available in the Estimated Measures of Sampling Variability table below.

Note: The shaded area indicates the range between the historical minimum and maximum values for the weekly series from 2021 through 2025. The dashed vertical lines indicate current and year-ago weekly periods.

Weather: There is still some risk for colder weather in March, but the Euro weeklies’ signal for consistently below-average temperatures in the second half of the month to fade—similar to what has been seen repeatedly over the past six weeks.

While severe weather season typically ramps up in March, there is currently no clear signal for a sustained pattern that would support a prolonged period of severe weather. The overall pattern looks active through the month, but a more favorable setup would require stronger western U.S. troughing to eject systems into the Plains.

Ridging is expected to persist in the Gulf of Alaska into March, and its exact placement will be key in determining how far west any troughing can develop across the lower 48. One notable feature emerging in the upper-level pattern is ridging across the Southeast. This would tend to push the storm track farther north and introduce a stronger southwest flow. As a result, even without well-defined western troughing, Southeast ridging could still allow periodic systems to lift northward through the Plains and support broader warm sectors.

At this point, March is shaping up to feature above-average temperatures across the Midwest and likely much of the country. Precipitation also looks to run above normal, particularly across the Corn Belt and the Ohio Valley. Midwest Weather. “Early or Late Spring.” Midwest Weather (Substack), 2026. Subscriber-only newsletter.

February 20, 2026

Weekly Energy News

Market Commentary: NYMEX natural gas futures have recently drifted closer to $3.00/MMBtu, as short-term U.S. weather forecasts point to weaker demand and slower-than-expected storage withdrawals.

Over the past three trading sessions, the March contract has tested the low $2.90s, reflecting a more bearish outlook for the remainder of the winter. By late trading on February 19, the March contract was hovering near $2.98/MMBtu—down about three cents on the day as the market approached settlement, according to CME data.

MAR26’ NYMEX closed Thursday at $2.996

· High for the day $3.095

· Low for the day $2.976

Early trading for the prompt month is trading at $3.008

· https://www.cmegroup.com/markets/energy/natural-gas/natural-gas.html

· https://www.fxempire.com/commodities/natural-gas

EIA Storage: U.S. natural gas storage withdrawals slowed in the week ending February 13, as milder temperatures across the Lower 48 reduced heating demand.

The U.S. Energy Information Administration reported a 144 Bcf withdrawal, bringing total working gas in storage down to 2.070 Tcf. The draw came in below market expectations. A Platts survey of analysts called for a 150 Bcf withdrawal.

Following the release of the report on February 19, the NYMEX March natural gas contract fell by roughly 7–8 cents, briefly trading just above $3.00 per MMBtu, according to CME data. In subsequent trading, the prompt-month contract rebounded and traded in a narrow range between $3.00 and $3.05 as the market digested the smaller-than-expected draw.

The latest report follows a string of unusually large withdrawals, including a 249 Bcf draw for the week ending February 6 and a record 360 Bcf withdrawal for the week ending January 30.

The slower draw for the week ending February 13 reflects a sharp decline in gas-fired heating demand, driven by warmer weather across the central and eastern United States.

Summary: According to EIA estimates, working gas in storage totaled 2,070 Bcf as of Friday, February 13, 2026. This reflects a 144 Bcf withdrawal from the prior week.

Storage levels are 59 Bcf lower than this time last year and 123 Bcf below the five-year average of 2,193 Bcf. At 2,070 Bcf, inventories remain within the five-year historical range.

Additional details on sampling error are available in the Estimated Measures of Sampling Variability table below.

Note: The shaded area indicates the range between the historical minimum and maximum values for the weekly series from 2021 through 2025. The dashed vertical lines indicate current and year-ago weekly periods.

Weather: There is still some risk for colder weather in March, but the Euro weeklies’ signal for consistently below-average temperatures in the second half of the month to fade—similar to what has been seen repeatedly over the past six weeks.

While severe weather season typically ramps up in March, there is currently no clear signal for a sustained pattern that would support a prolonged period of severe weather. The overall pattern looks active through the month, but a more favorable setup would require stronger western U.S. troughing to eject systems into the Plains.

Ridging is expected to persist in the Gulf of Alaska into March, and its exact placement will be key in determining how far west any troughing can develop across the lower 48. One notable feature emerging in the upper-level pattern is ridging across the Southeast. This would tend to push the storm track farther north and introduce a stronger southwest flow. As a result, even without well-defined western troughing, Southeast ridging could still allow periodic systems to lift northward through the Plains and support broader warm sectors.

At this point, March is shaping up to feature above-average temperatures across the Midwest and likely much of the country. Precipitation also looks to run above normal, particularly across the Corn Belt and the Ohio Valley. Midwest Weather. “Early or Late Spring.” Midwest Weather (Substack), 2026. Subscriber-only newsletter.

Enroll in Choice Gas with Three Easy Steps

Click here to access our online Choice tool, or call our Choice gas experts at 1 (877) 790-4990.

Step 1: Enter your account number

- Your Black Hills Energy account number is located at the top right-hand corner of your bill.

Step 2: Review price offers and make your selection

Step 3: Confirm your selection and enter your control number

- You received a control number in your 2025 Choice Gas customer packet mailed to you from Black Hills Energy. If you cannot locate this, you can retrieve your control number by calling 877-245-3506 or visit choicegas.com

Once enrolled, you will be removed from supplier marketing communications within 24 hours.