February 13, 2026

Weekly Energy News

Market Commentary: Immediately following the release of the EIA's storage report, the NYMEX March gas futures contract experienced a decline of approximately 4-5 cents, settling around the low $3.20 range per million British thermal units. For the following hour and a half, trading had movement, with prices varying between $3.20 and $3.27/MMBtu, as reported by CME Group. After spiking into the mid-$7s/MMBtu in late January, the NYMEX prompt-month gas futures have seen a significant downturn in recent trades, coinciding with a more moderate short-term weather forecast for the US. On January 29, the March gas futures contract transitioned to the front-month position at $3.918/MMBtu. Following a peak of $4.35/MMBtu on January 30, prices have gradually decreased. The March contract hit an intraday low of just $3.05/MMBtu on February 11, according to Platts, a division of S&P Global Energy.

MAR26’ NYMEX closed Thursday at $3.217 (up $.058)

· High for the day $3.180

· Low for the day $3.316

Early trading for the prompt month is trading at $3.133

- https://www.cmegroup.com/markets/energy/natural-gas/natural-gas.html

- https://www.fxempire.com/commodities/natural-gas

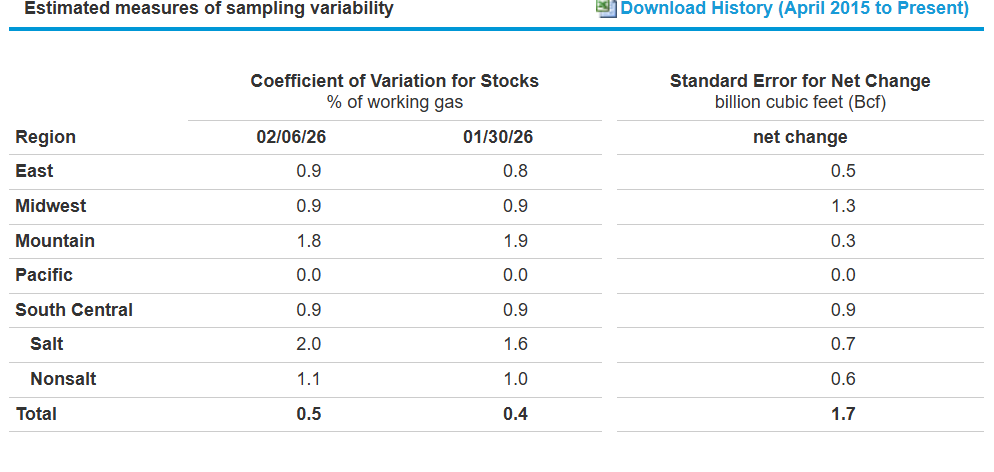

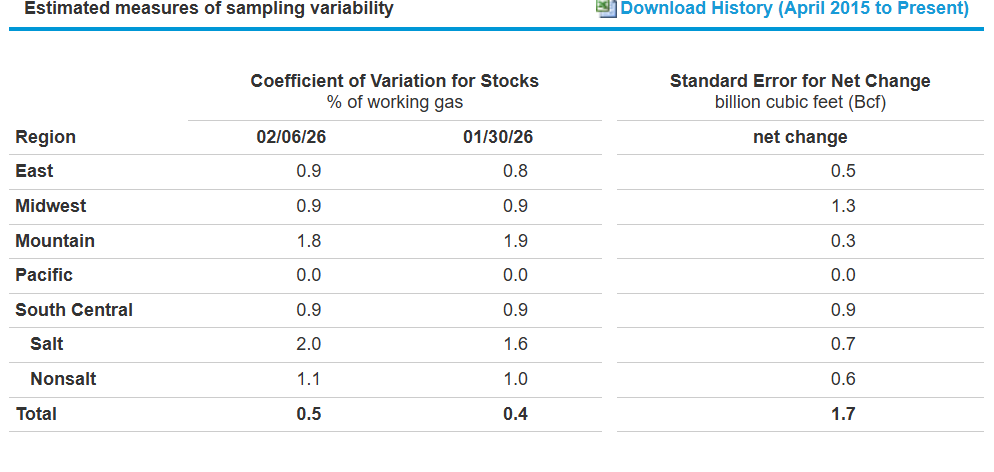

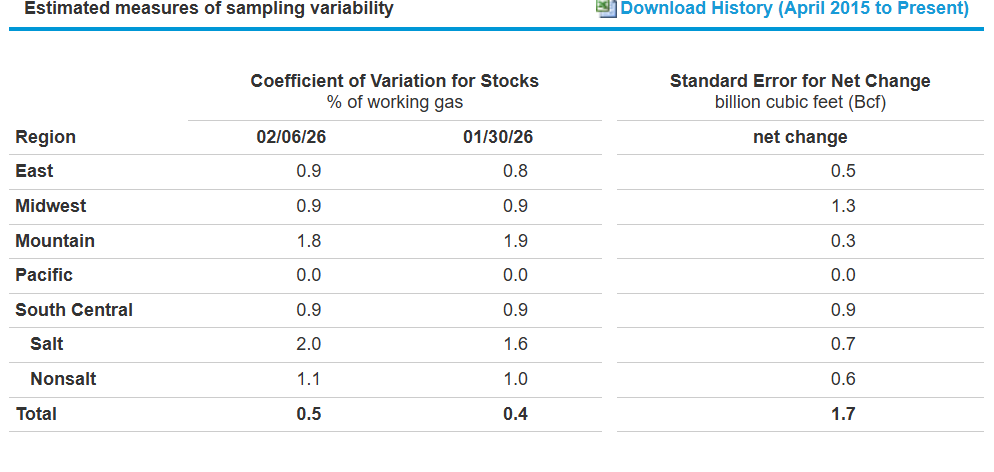

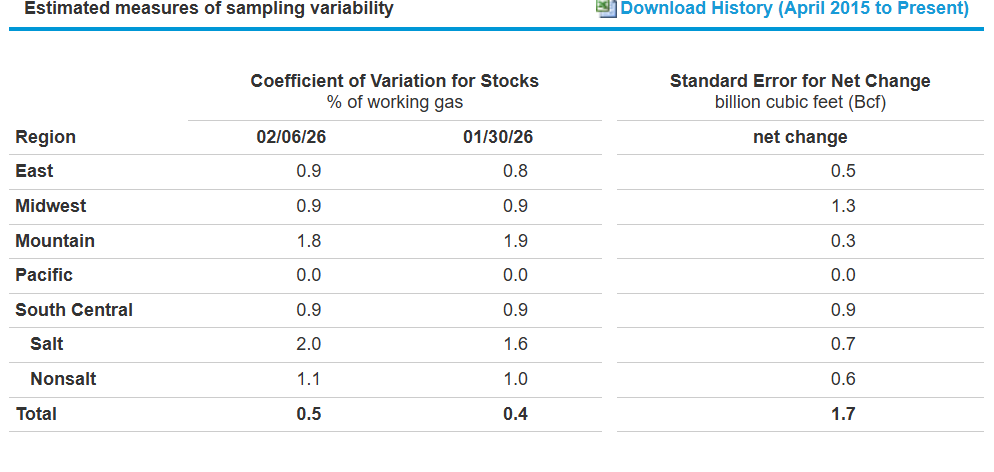

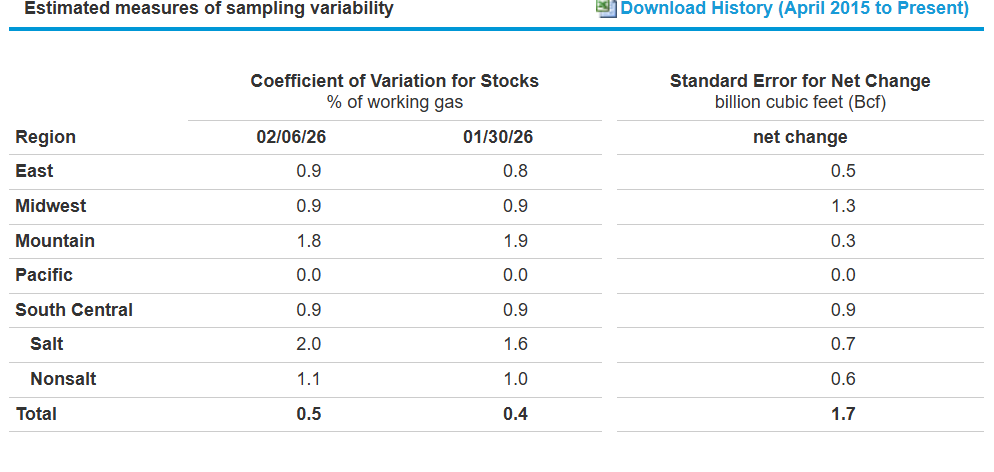

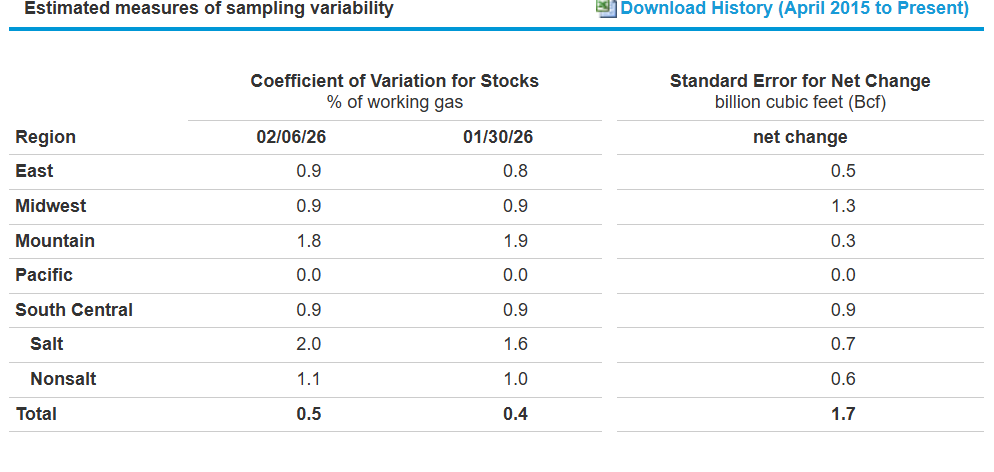

EIA Storage: During the week ending February 13, gas demand in the U.S. continued to decline as temperatures rose across the eastern half of the country. A reduction of over 9 Bcf/d in residential and commercial gas demand coincided with drops in power and industrial usage. Overall, U.S. gas demand has fallen by nearly 15 Bcf/d compared to the previous week, according to S&P Global Energy CERA. Most analysts expect the EIA to report another smaller withdrawal from domestic inventory for the week ending February 13. As of Feb. 6, U.S. gas inventories were 130 Bcf, or about 5.5 percent below the five-year average, or about 4 percent % below the year-ago level, EIA data showed.

Summary: Working gas in storage was 2,214 Bcf as of Friday, February 6, 2026, according to EIA estimates. This represents a net decrease of 249 Bcf from the previous week. Stocks were 97 Bcf less than last year at this time and 130 Bcf below the five-year average of 2,344 Bcf. At 2,214 Bcf, total working gas is within the five-year historical range.

Note: The shaded area indicates the range between the historical minimum and maximum values for the weekly series from 2021 through 2025. The dashed vertical lines indicate current and year-ago weekly periods.

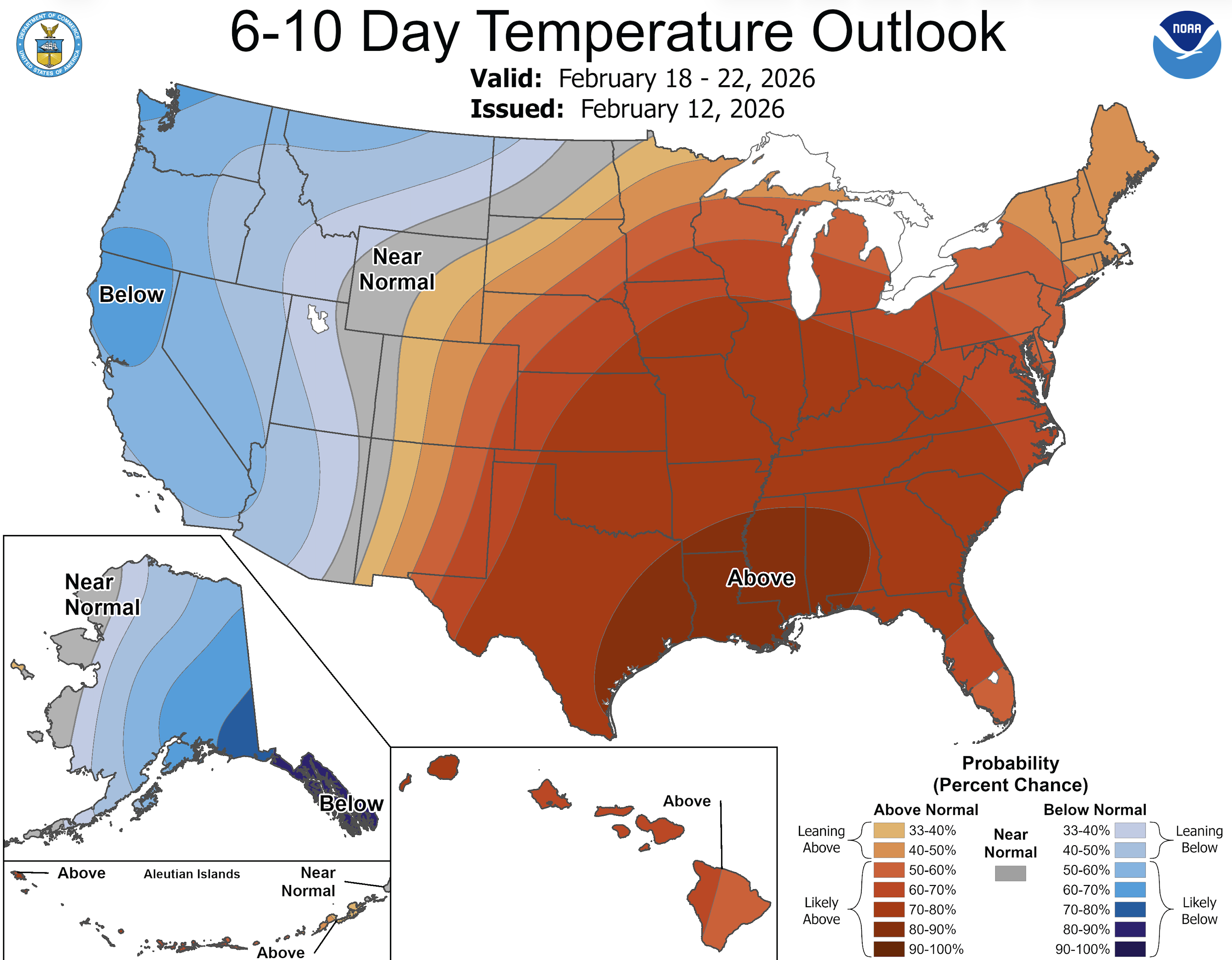

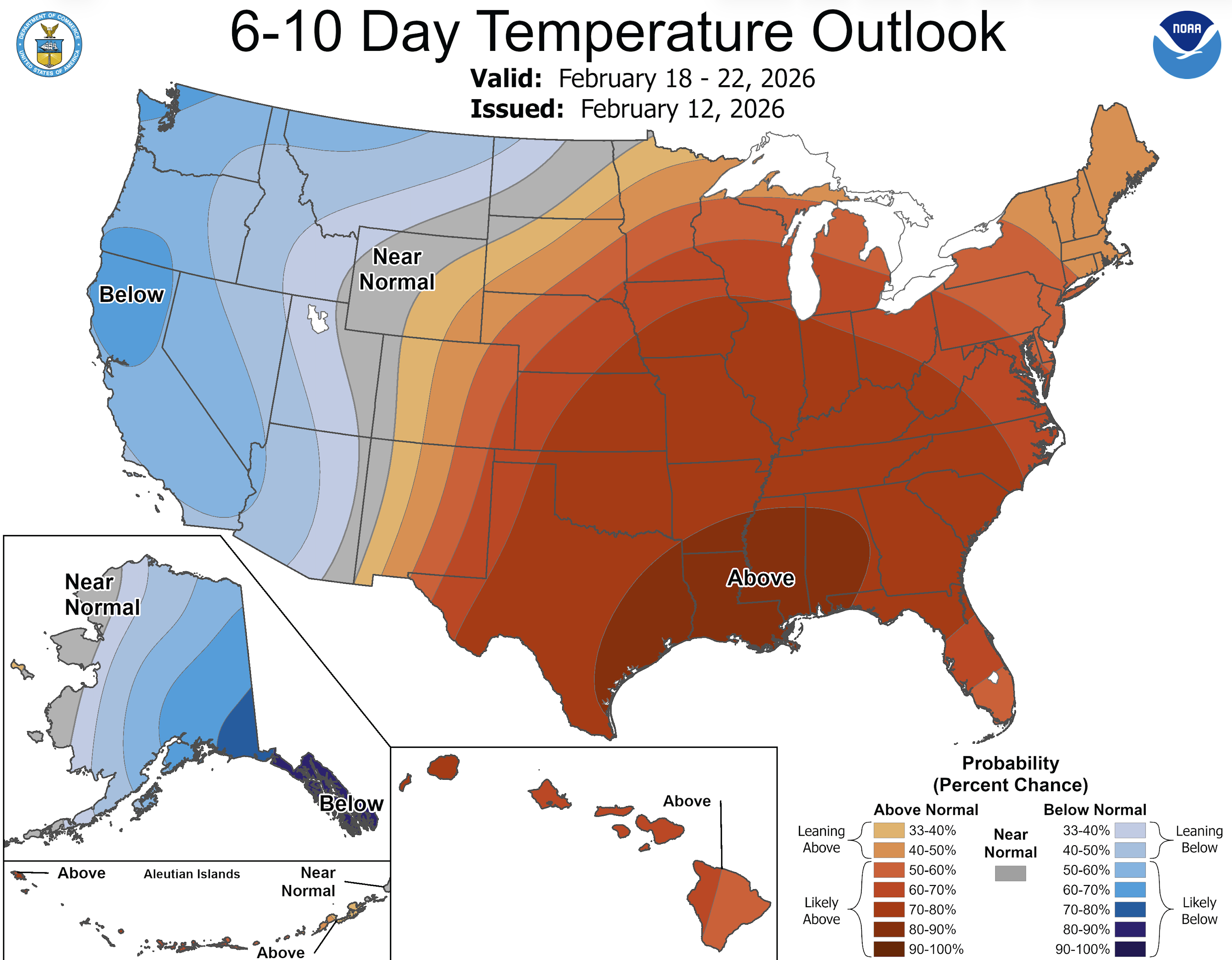

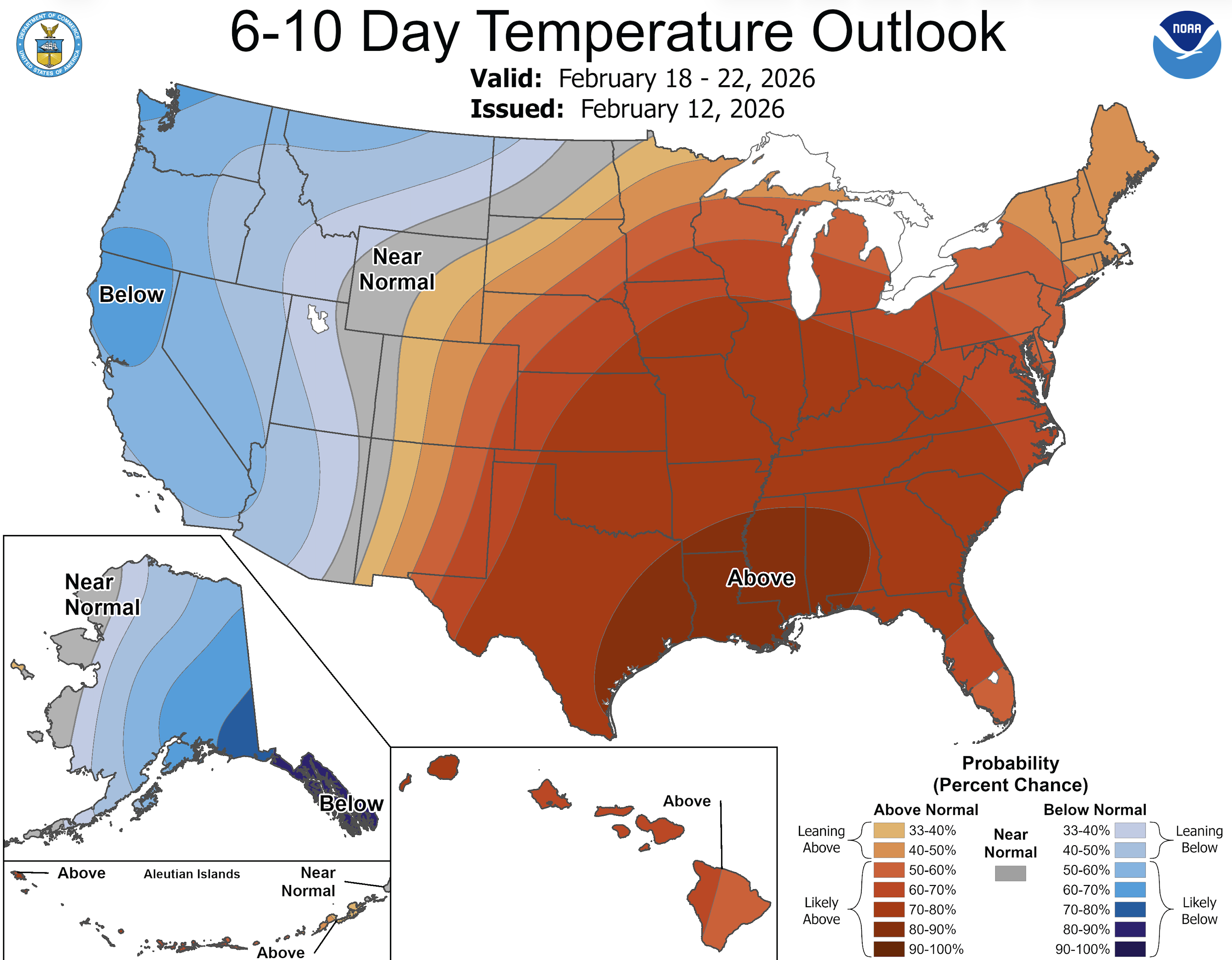

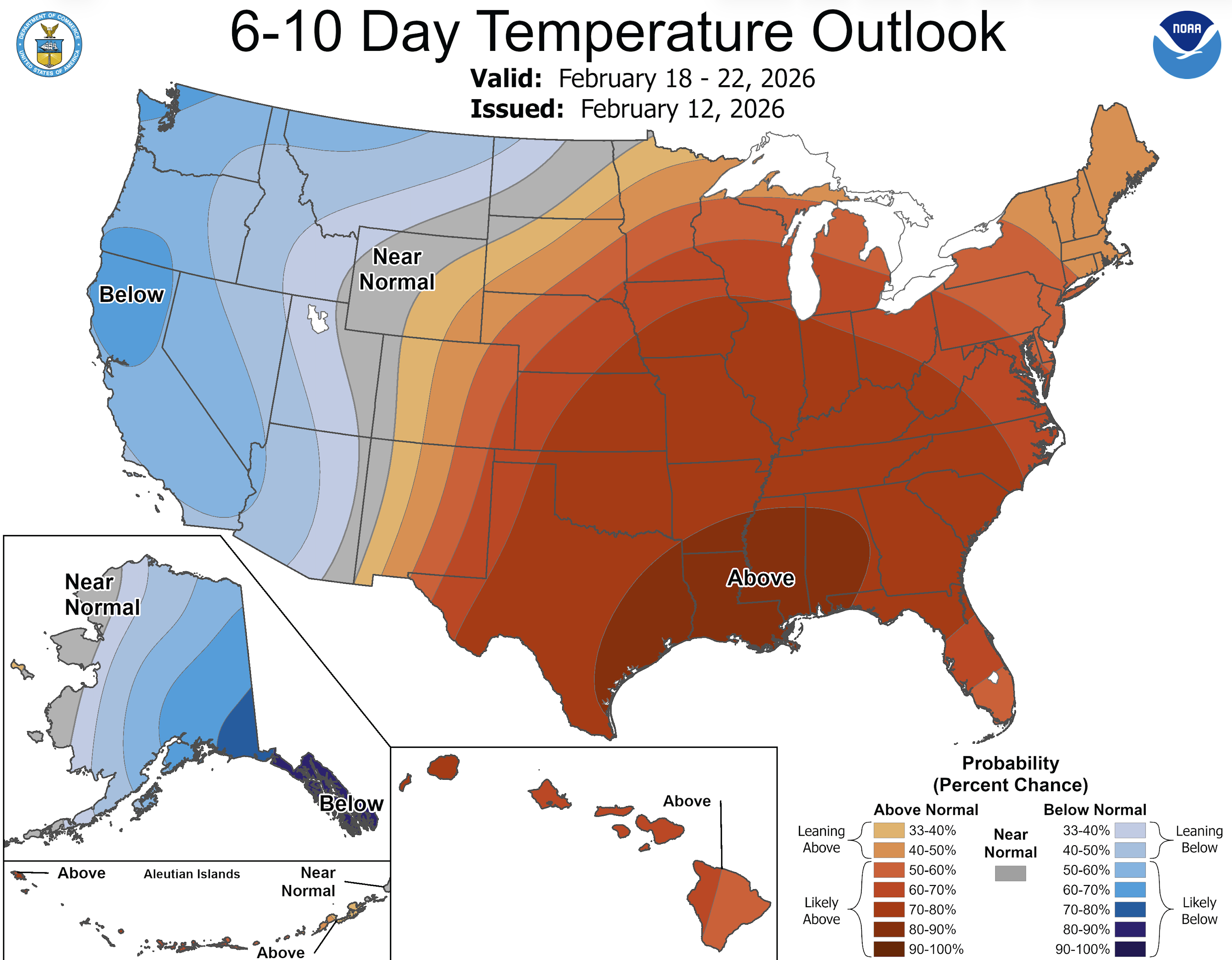

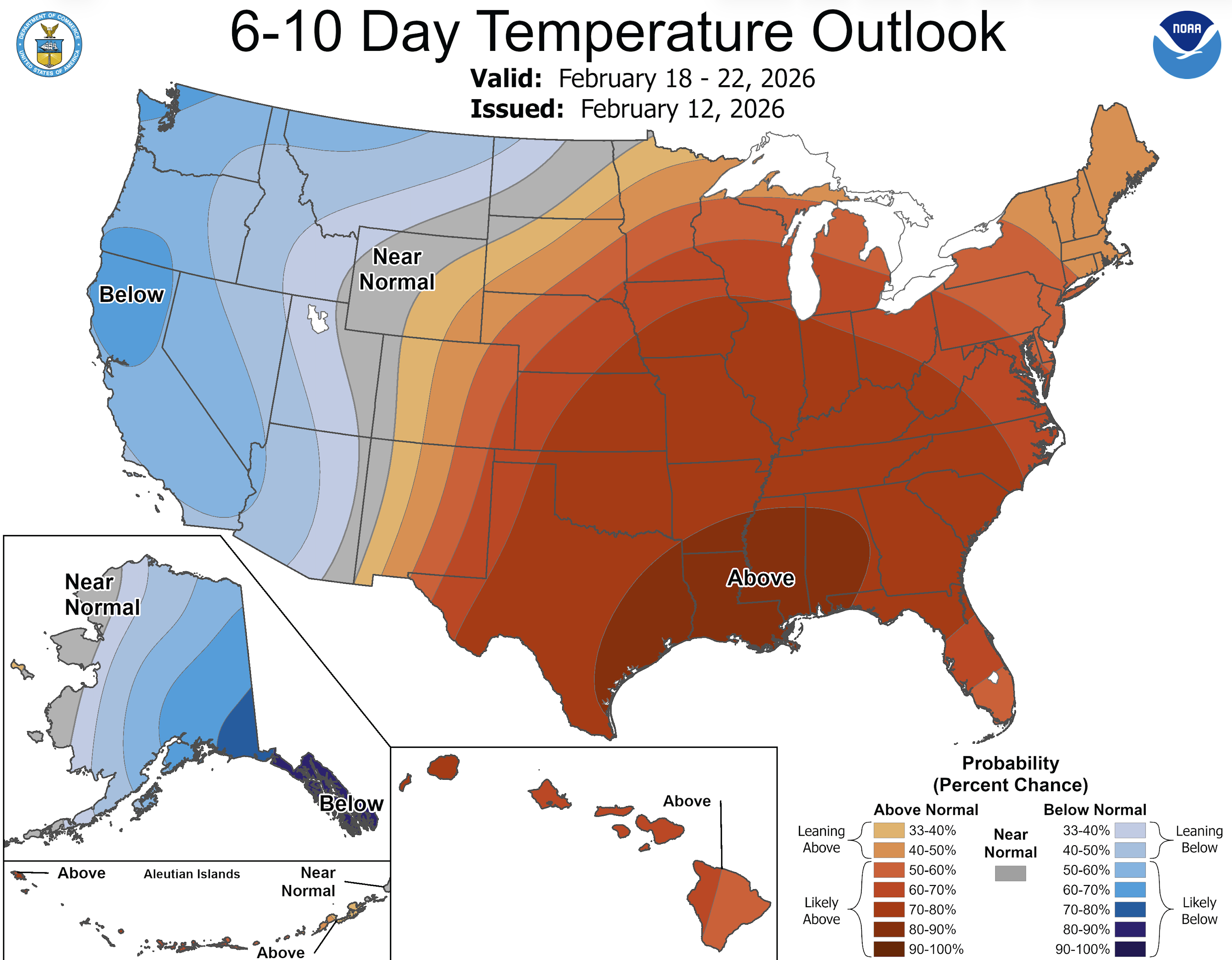

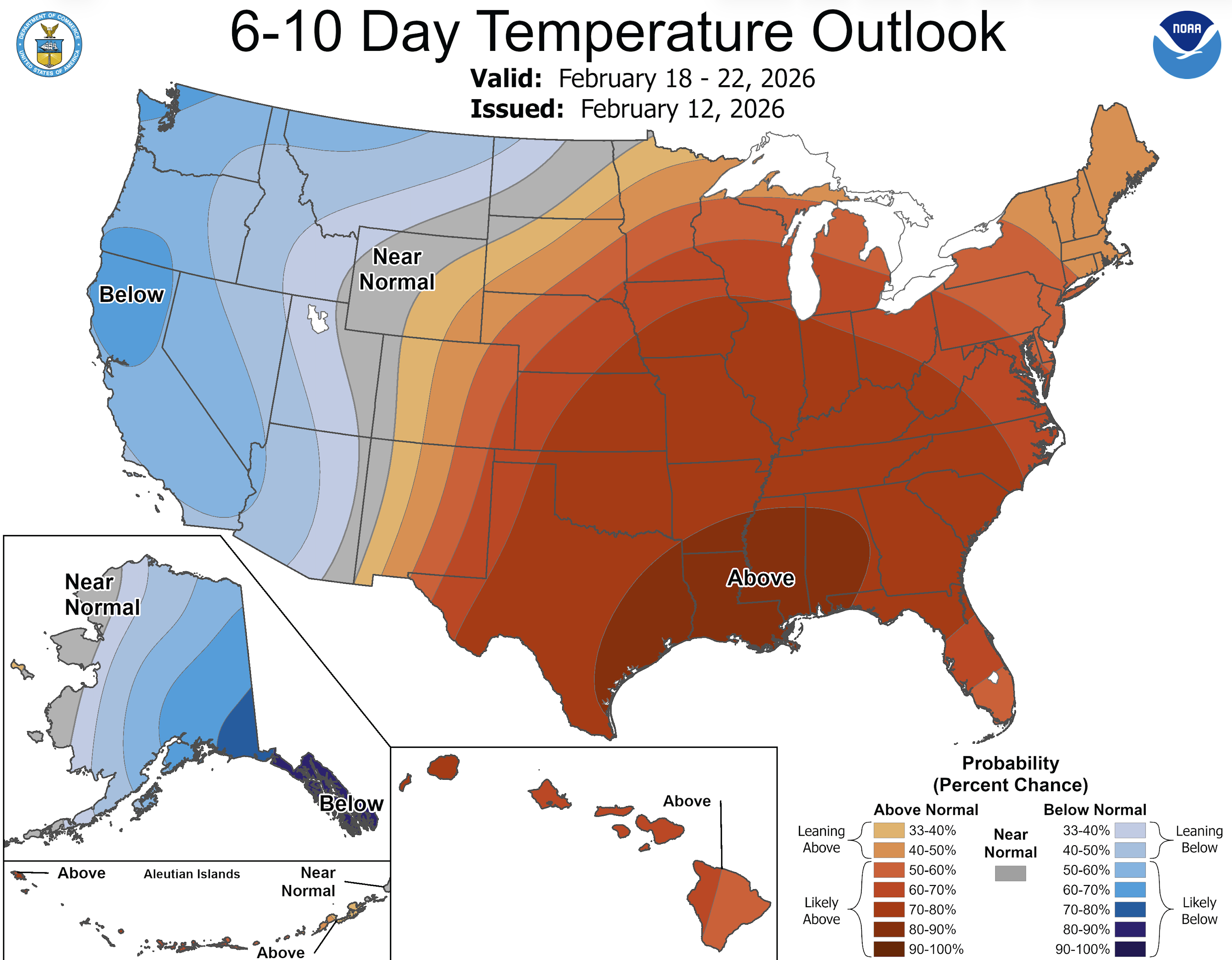

Weather: A warm weather surge is expected to hit the cold-weary central and eastern U.S. during the third week of February, bringing relief to millions but also potential issues. AccuWeather's Lead Long-Range Meteorologist Paul Pastelok warns that while the harshest cold is fading, winter isn’t finished yet. This upcoming warmth could introduce new risks as colder, stormier weather moves to the West. From January 24 to February 9, many areas in the central and eastern U.S. experienced some of the coldest temperatures in years, with averages dropping over 10 degrees below the historical norm. Pittsburgh saw lows of 17 degrees Fahrenheit below average, Buffalo experienced 15 degrees below, and Washington, D.C. recorded 14.7 degrees below. Highs often remained in the single digits, teens, and 20s, while nighttime temperatures dropped below zero. In the southern and western regions, averages were 6 to 12 degrees under the norm, leading to significant freezes and damage to citrus crops.

February 13, 2026

Weekly Energy News

Market Commentary: Immediately following the release of the EIA's storage report, the NYMEX March gas futures contract experienced a decline of approximately 4-5 cents, settling around the low $3.20 range per million British thermal units. For the following hour and a half, trading had movement, with prices varying between $3.20 and $3.27/MMBtu, as reported by CME Group. After spiking into the mid-$7s/MMBtu in late January, the NYMEX prompt-month gas futures have seen a significant downturn in recent trades, coinciding with a more moderate short-term weather forecast for the US. On January 29, the March gas futures contract transitioned to the front-month position at $3.918/MMBtu. Following a peak of $4.35/MMBtu on January 30, prices have gradually decreased. The March contract hit an intraday low of just $3.05/MMBtu on February 11, according to Platts, a division of S&P Global Energy.

MAR26’ NYMEX closed Thursday at $3.217 (up $.058)

· High for the day $3.180

· Low for the day $3.316

Early trading for the prompt month is trading at $3.133

- https://www.cmegroup.com/markets/energy/natural-gas/natural-gas.html

- https://www.fxempire.com/commodities/natural-gas

EIA Storage: During the week ending February 13, gas demand in the U.S. continued to decline as temperatures rose across the eastern half of the country. A reduction of over 9 Bcf/d in residential and commercial gas demand coincided with drops in power and industrial usage. Overall, U.S. gas demand has fallen by nearly 15 Bcf/d compared to the previous week, according to S&P Global Energy CERA. Most analysts expect the EIA to report another smaller withdrawal from domestic inventory for the week ending February 13. As of Feb. 6, U.S. gas inventories were 130 Bcf, or about 5.5 percent below the five-year average, or about 4 percent % below the year-ago level, EIA data showed.

Summary: Working gas in storage was 2,214 Bcf as of Friday, February 6, 2026, according to EIA estimates. This represents a net decrease of 249 Bcf from the previous week. Stocks were 97 Bcf less than last year at this time and 130 Bcf below the five-year average of 2,344 Bcf. At 2,214 Bcf, total working gas is within the five-year historical range.

Note: The shaded area indicates the range between the historical minimum and maximum values for the weekly series from 2021 through 2025. The dashed vertical lines indicate current and year-ago weekly periods.

Weather: A warm weather surge is expected to hit the cold-weary central and eastern U.S. during the third week of February, bringing relief to millions but also potential issues. AccuWeather's Lead Long-Range Meteorologist Paul Pastelok warns that while the harshest cold is fading, winter isn’t finished yet. This upcoming warmth could introduce new risks as colder, stormier weather moves to the West. From January 24 to February 9, many areas in the central and eastern U.S. experienced some of the coldest temperatures in years, with averages dropping over 10 degrees below the historical norm. Pittsburgh saw lows of 17 degrees Fahrenheit below average, Buffalo experienced 15 degrees below, and Washington, D.C. recorded 14.7 degrees below. Highs often remained in the single digits, teens, and 20s, while nighttime temperatures dropped below zero. In the southern and western regions, averages were 6 to 12 degrees under the norm, leading to significant freezes and damage to citrus crops.

February 13, 2026

Weekly Energy News

Market Commentary: Immediately following the release of the EIA's storage report, the NYMEX March gas futures contract experienced a decline of approximately 4-5 cents, settling around the low $3.20 range per million British thermal units. For the following hour and a half, trading had movement, with prices varying between $3.20 and $3.27/MMBtu, as reported by CME Group. After spiking into the mid-$7s/MMBtu in late January, the NYMEX prompt-month gas futures have seen a significant downturn in recent trades, coinciding with a more moderate short-term weather forecast for the US. On January 29, the March gas futures contract transitioned to the front-month position at $3.918/MMBtu. Following a peak of $4.35/MMBtu on January 30, prices have gradually decreased. The March contract hit an intraday low of just $3.05/MMBtu on February 11, according to Platts, a division of S&P Global Energy.

MAR26’ NYMEX closed Thursday at $3.217 (up $.058)

· High for the day $3.180

· Low for the day $3.316

Early trading for the prompt month is trading at $3.133

- https://www.cmegroup.com/markets/energy/natural-gas/natural-gas.html

- https://www.fxempire.com/commodities/natural-gas

EIA Storage: During the week ending February 13, gas demand in the U.S. continued to decline as temperatures rose across the eastern half of the country. A reduction of over 9 Bcf/d in residential and commercial gas demand coincided with drops in power and industrial usage. Overall, U.S. gas demand has fallen by nearly 15 Bcf/d compared to the previous week, according to S&P Global Energy CERA. Most analysts expect the EIA to report another smaller withdrawal from domestic inventory for the week ending February 13. As of Feb. 6, U.S. gas inventories were 130 Bcf, or about 5.5 percent below the five-year average, or about 4 percent % below the year-ago level, EIA data showed.

Summary: Working gas in storage was 2,214 Bcf as of Friday, February 6, 2026, according to EIA estimates. This represents a net decrease of 249 Bcf from the previous week. Stocks were 97 Bcf less than last year at this time and 130 Bcf below the five-year average of 2,344 Bcf. At 2,214 Bcf, total working gas is within the five-year historical range.

Note: The shaded area indicates the range between the historical minimum and maximum values for the weekly series from 2021 through 2025. The dashed vertical lines indicate current and year-ago weekly periods.

Weather: A warm weather surge is expected to hit the cold-weary central and eastern U.S. during the third week of February, bringing relief to millions but also potential issues. AccuWeather's Lead Long-Range Meteorologist Paul Pastelok warns that while the harshest cold is fading, winter isn’t finished yet. This upcoming warmth could introduce new risks as colder, stormier weather moves to the West. From January 24 to February 9, many areas in the central and eastern U.S. experienced some of the coldest temperatures in years, with averages dropping over 10 degrees below the historical norm. Pittsburgh saw lows of 17 degrees Fahrenheit below average, Buffalo experienced 15 degrees below, and Washington, D.C. recorded 14.7 degrees below. Highs often remained in the single digits, teens, and 20s, while nighttime temperatures dropped below zero. In the southern and western regions, averages were 6 to 12 degrees under the norm, leading to significant freezes and damage to citrus crops.

February 13, 2026

Market Commentary: Immediately following the release of the EIA's storage report, the NYMEX March gas futures contract experienced a decline of approximately 4-5 cents, settling around the low $3.20 range per million British thermal units. For the following hour and a half, trading had movement, with prices varying between $3.20 and $3.27/MMBtu, as reported by CME Group. After spiking into the mid-$7s/MMBtu in late January, the NYMEX prompt-month gas futures have seen a significant downturn in recent trades, coinciding with a more moderate short-term weather forecast for the US. On January 29, the March gas futures contract transitioned to the front-month position at $3.918/MMBtu. Following a peak of $4.35/MMBtu on January 30, prices have gradually decreased. The March contract hit an intraday low of just $3.05/MMBtu on February 11, according to Platts, a division of S&P Global Energy.

MAR26’ NYMEX closed Thursday at $3.217 (up $.058)

· High for the day $3.180

· Low for the day $3.316

Early trading for the prompt month is trading at $3.133

- https://www.cmegroup.com/markets/energy/natural-gas/natural-gas.html

- https://www.fxempire.com/commodities/natural-gas

EIA Storage: During the week ending February 13, gas demand in the U.S. continued to decline as temperatures rose across the eastern half of the country. A reduction of over 9 Bcf/d in residential and commercial gas demand coincided with drops in power and industrial usage. Overall, U.S. gas demand has fallen by nearly 15 Bcf/d compared to the previous week, according to S&P Global Energy CERA. Most analysts expect the EIA to report another smaller withdrawal from domestic inventory for the week ending February 13. As of Feb. 6, U.S. gas inventories were 130 Bcf, or about 5.5 percent below the five-year average, or about 4 percent % below the year-ago level, EIA data showed.

Summary: Working gas in storage was 2,214 Bcf as of Friday, February 6, 2026, according to EIA estimates. This represents a net decrease of 249 Bcf from the previous week. Stocks were 97 Bcf less than last year at this time and 130 Bcf below the five-year average of 2,344 Bcf. At 2,214 Bcf, total working gas is within the five-year historical range.

Note: The shaded area indicates the range between the historical minimum and maximum values for the weekly series from 2021 through 2025. The dashed vertical lines indicate current and year-ago weekly periods.

Weather: A warm weather surge is expected to hit the cold-weary central and eastern U.S. during the third week of February, bringing relief to millions but also potential issues. AccuWeather's Lead Long-Range Meteorologist Paul Pastelok warns that while the harshest cold is fading, winter isn’t finished yet. This upcoming warmth could introduce new risks as colder, stormier weather moves to the West. From January 24 to February 9, many areas in the central and eastern U.S. experienced some of the coldest temperatures in years, with averages dropping over 10 degrees below the historical norm. Pittsburgh saw lows of 17 degrees Fahrenheit below average, Buffalo experienced 15 degrees below, and Washington, D.C. recorded 14.7 degrees below. Highs often remained in the single digits, teens, and 20s, while nighttime temperatures dropped below zero. In the southern and western regions, averages were 6 to 12 degrees under the norm, leading to significant freezes and damage to citrus crops.

February 13, 2026

Weekly Energy News

Market Commentary: Immediately following the release of the EIA's storage report, the NYMEX March gas futures contract experienced a decline of approximately 4-5 cents, settling around the low $3.20 range per million British thermal units. For the following hour and a half, trading had movement, with prices varying between $3.20 and $3.27/MMBtu, as reported by CME Group. After spiking into the mid-$7s/MMBtu in late January, the NYMEX prompt-month gas futures have seen a significant downturn in recent trades, coinciding with a more moderate short-term weather forecast for the US. On January 29, the March gas futures contract transitioned to the front-month position at $3.918/MMBtu. Following a peak of $4.35/MMBtu on January 30, prices have gradually decreased. The March contract hit an intraday low of just $3.05/MMBtu on February 11, according to Platts, a division of S&P Global Energy.

MAR26’ NYMEX closed Thursday at $3.217 (up $.058)

· High for the day $3.180

· Low for the day $3.316

Early trading for the prompt month is trading at $3.133

- https://www.cmegroup.com/markets/energy/natural-gas/natural-gas.html

- https://www.fxempire.com/commodities/natural-gas

EIA Storage: During the week ending February 13, gas demand in the U.S. continued to decline as temperatures rose across the eastern half of the country. A reduction of over 9 Bcf/d in residential and commercial gas demand coincided with drops in power and industrial usage. Overall, U.S. gas demand has fallen by nearly 15 Bcf/d compared to the previous week, according to S&P Global Energy CERA. Most analysts expect the EIA to report another smaller withdrawal from domestic inventory for the week ending February 13. As of Feb. 6, U.S. gas inventories were 130 Bcf, or about 5.5 percent below the five-year average, or about 4 percent % below the year-ago level, EIA data showed.

Summary: Working gas in storage was 2,214 Bcf as of Friday, February 6, 2026, according to EIA estimates. This represents a net decrease of 249 Bcf from the previous week. Stocks were 97 Bcf less than last year at this time and 130 Bcf below the five-year average of 2,344 Bcf. At 2,214 Bcf, total working gas is within the five-year historical range.

Note: The shaded area indicates the range between the historical minimum and maximum values for the weekly series from 2021 through 2025. The dashed vertical lines indicate current and year-ago weekly periods.

Weather: A warm weather surge is expected to hit the cold-weary central and eastern U.S. during the third week of February, bringing relief to millions but also potential issues. AccuWeather's Lead Long-Range Meteorologist Paul Pastelok warns that while the harshest cold is fading, winter isn’t finished yet. This upcoming warmth could introduce new risks as colder, stormier weather moves to the West. From January 24 to February 9, many areas in the central and eastern U.S. experienced some of the coldest temperatures in years, with averages dropping over 10 degrees below the historical norm. Pittsburgh saw lows of 17 degrees Fahrenheit below average, Buffalo experienced 15 degrees below, and Washington, D.C. recorded 14.7 degrees below. Highs often remained in the single digits, teens, and 20s, while nighttime temperatures dropped below zero. In the southern and western regions, averages were 6 to 12 degrees under the norm, leading to significant freezes and damage to citrus crops.

February 13, 2026

Weekly Energy News

Market Commentary: Immediately following the release of the EIA's storage report, the NYMEX March gas futures contract experienced a decline of approximately 4-5 cents, settling around the low $3.20 range per million British thermal units. For the following hour and a half, trading had movement, with prices varying between $3.20 and $3.27/MMBtu, as reported by CME Group. After spiking into the mid-$7s/MMBtu in late January, the NYMEX prompt-month gas futures have seen a significant downturn in recent trades, coinciding with a more moderate short-term weather forecast for the US. On January 29, the March gas futures contract transitioned to the front-month position at $3.918/MMBtu. Following a peak of $4.35/MMBtu on January 30, prices have gradually decreased. The March contract hit an intraday low of just $3.05/MMBtu on February 11, according to Platts, a division of S&P Global Energy.

MAR26’ NYMEX closed Thursday at $3.217 (up $.058)

· High for the day $3.180

· Low for the day $3.316

Early trading for the prompt month is trading at $3.133

- https://www.cmegroup.com/markets/energy/natural-gas/natural-gas.html

- https://www.fxempire.com/commodities/natural-gas

EIA Storage: During the week ending February 13, gas demand in the U.S. continued to decline as temperatures rose across the eastern half of the country. A reduction of over 9 Bcf/d in residential and commercial gas demand coincided with drops in power and industrial usage. Overall, U.S. gas demand has fallen by nearly 15 Bcf/d compared to the previous week, according to S&P Global Energy CERA. Most analysts expect the EIA to report another smaller withdrawal from domestic inventory for the week ending February 13. As of Feb. 6, U.S. gas inventories were 130 Bcf, or about 5.5 percent below the five-year average, or about 4 percent % below the year-ago level, EIA data showed.

Summary: Working gas in storage was 2,214 Bcf as of Friday, February 6, 2026, according to EIA estimates. This represents a net decrease of 249 Bcf from the previous week. Stocks were 97 Bcf less than last year at this time and 130 Bcf below the five-year average of 2,344 Bcf. At 2,214 Bcf, total working gas is within the five-year historical range.

Note: The shaded area indicates the range between the historical minimum and maximum values for the weekly series from 2021 through 2025. The dashed vertical lines indicate current and year-ago weekly periods.

Weather: A warm weather surge is expected to hit the cold-weary central and eastern U.S. during the third week of February, bringing relief to millions but also potential issues. AccuWeather's Lead Long-Range Meteorologist Paul Pastelok warns that while the harshest cold is fading, winter isn’t finished yet. This upcoming warmth could introduce new risks as colder, stormier weather moves to the West. From January 24 to February 9, many areas in the central and eastern U.S. experienced some of the coldest temperatures in years, with averages dropping over 10 degrees below the historical norm. Pittsburgh saw lows of 17 degrees Fahrenheit below average, Buffalo experienced 15 degrees below, and Washington, D.C. recorded 14.7 degrees below. Highs often remained in the single digits, teens, and 20s, while nighttime temperatures dropped below zero. In the southern and western regions, averages were 6 to 12 degrees under the norm, leading to significant freezes and damage to citrus crops.

Enroll in Choice Gas with Three Easy Steps

Click here to access our online Choice tool, or call our Choice gas experts at 1 (877) 790-4990.

Step 1: Enter your account number

- Your Black Hills Energy account number is located at the top right-hand corner of your bill.

Step 2: Review price offers and make your selection

Step 3: Confirm your selection and enter your control number

- You received a control number in your 2025 Choice Gas customer packet mailed to you from Black Hills Energy. If you cannot locate this, you can retrieve your control number by calling 877-245-3506 or visit choicegas.com

Once enrolled, you will be removed from supplier marketing communications within 24 hours.